Understanding

the Underbanked

According to Kantar’s U.S. MONITOR, 23% of adult Americans (18+) are underbanked, a term describing those who have a traditional bank account but also use alternative financing products, including taking out a payday loan or advance, getting a tax refund advance or paying a fee to cash a check at a bank or other business. The question is, just who are these individuals? And why should marketers care?

Financially Engaged Shoppers

While conventional wisdom may have it that the underbanked are low-income, low-value consumers who are less likely to be worth a marketer’s time, in reality U.S. MONITOR data reveals a very different picture.

Sixty percent of the underbanked are employed full time, while more than half have a household income greater than $75,000. They are more likely to be young (52% are Millennials) as well as urban (40%).

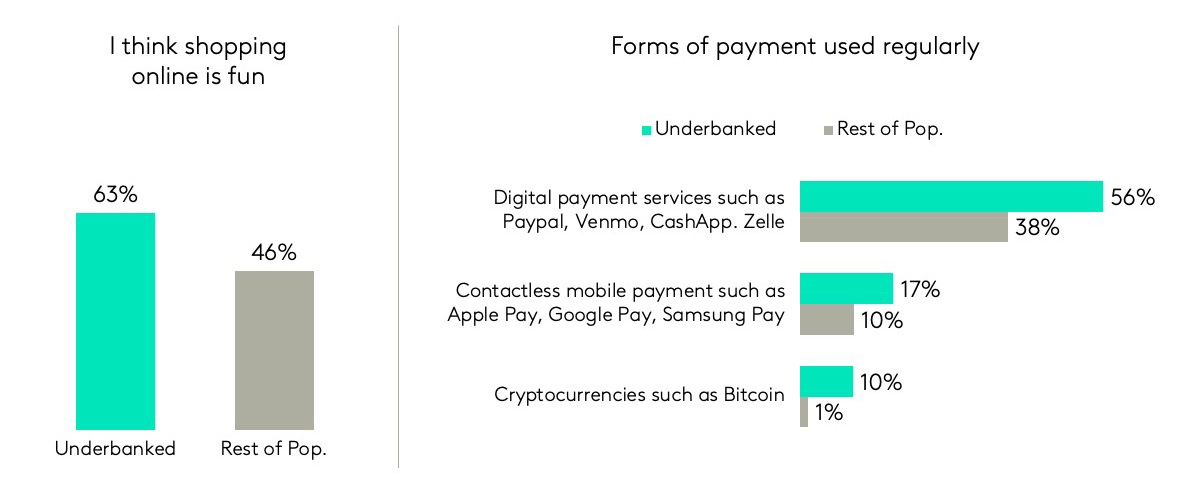

Notably, underbanked does not equal unengaged. In fact, the underbanked are enthusiastic shoppers who are more likely than others to see shopping as a fun and enjoyable event (63% vs. 46%) making them an attractive segment for retailers and other consumer brands.

Kantar U.S. MONITOR 2022 Survey

Further, from a financial standpoint the underbanked are more likely to value the role money plays in their lives and more likely to be active with digital financial products that signal the future of the financial marketplace, from digital payment and banking products like Paypal and Zelle and cryptocurrencies.

Financially Insecure

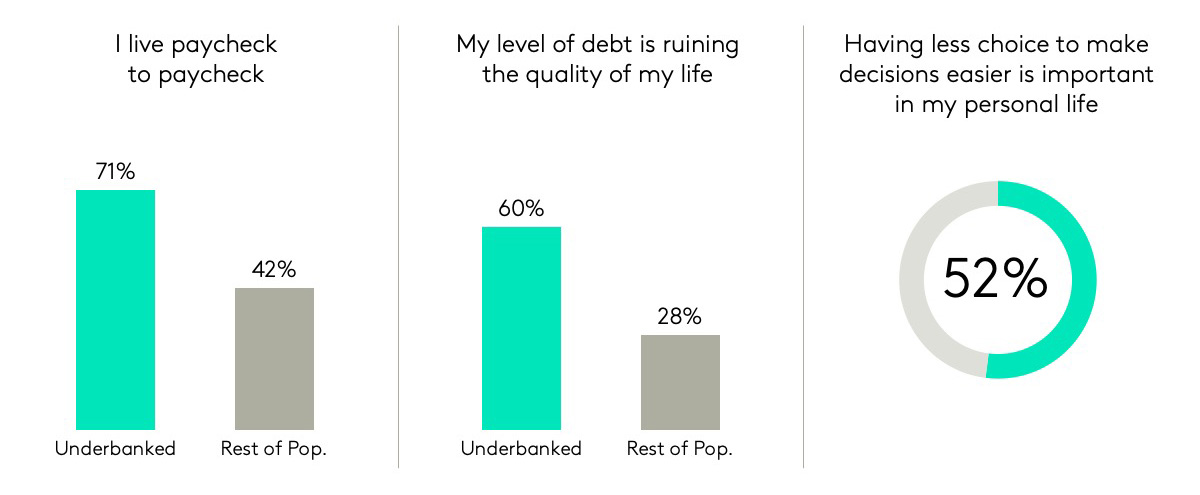

While the underbanked are enthusiastic and financially oriented consumers, there are characteristics of this group that point to why they are utilizing alternative financing products that the majority of consumers do not. Sixty-four percent of the underbanked say that they do not have enough discipline when spending money, while 71% report living paycheck to paycheck and 60% feel their level of debt is ruining the quality of their lives. Businesses that can relieve some of this stress and tension will attract these customers—most of them (52%) say that having fewer choices and an easier time making decisions are important qualities in their lives.

Kantar U.S. MONITOR 2022 Survey

An Opportunity for Brands—Financial and Otherwise

Financial insecurity leads to poor financial wellbeing, and the resulting stress and anxiety can leave consumers yearning for help—help that brands and businesses can provide. Financial inclusion initiatives—efforts that provide availability and equality of opportunities for all people to access financial services—are a primary lever that institutions can use to reduce financial stress and increase financial options for underbanked (and unbanked) Americans.

Many larger financial institutions are already doing their part by making investments in local and minority-owned banks to increase financial inclusion. As an example, Fifth Third has continuously invested in banks like Detroit’s First Independence Bank in order to increase loan participation and financial literacy courses for its underserved community. Other types of financial institutions are making strong efforts as well. CFE Fund, for instance, partners with local financial service providers on its Bank On platform, which offers safe alternatives to the risky financial products some consumers such as the underbanked occasionally turn to.

Even brands outside of the financial services category are recognizing the opportunity and stepping up. T-Mobile, for example, is offering high interest accounts, debit cards and plenty of waived feeds via its T-Mobile MONEY service, while PrimaHealth Credit is applying the “buy now, pay later” retail model to the healthcare space, allowing credit-challenged and underbanked patients to get the effective healthcare treatment they need.

Together these initiatives signal that the marketplace as a whole is adapting to the needs of under- and unbanked consumers, but there is still plenty of room for brands to seize the opportunity.